The Power of an Outside Perspective: How Fractional CFO Insight Strengthens Financial Processes for the Long Term

Executive Summary

Organizations often operate with financial processes that have evolved over time rather than being intentionally designed for performance, scalability, and strategic insight.

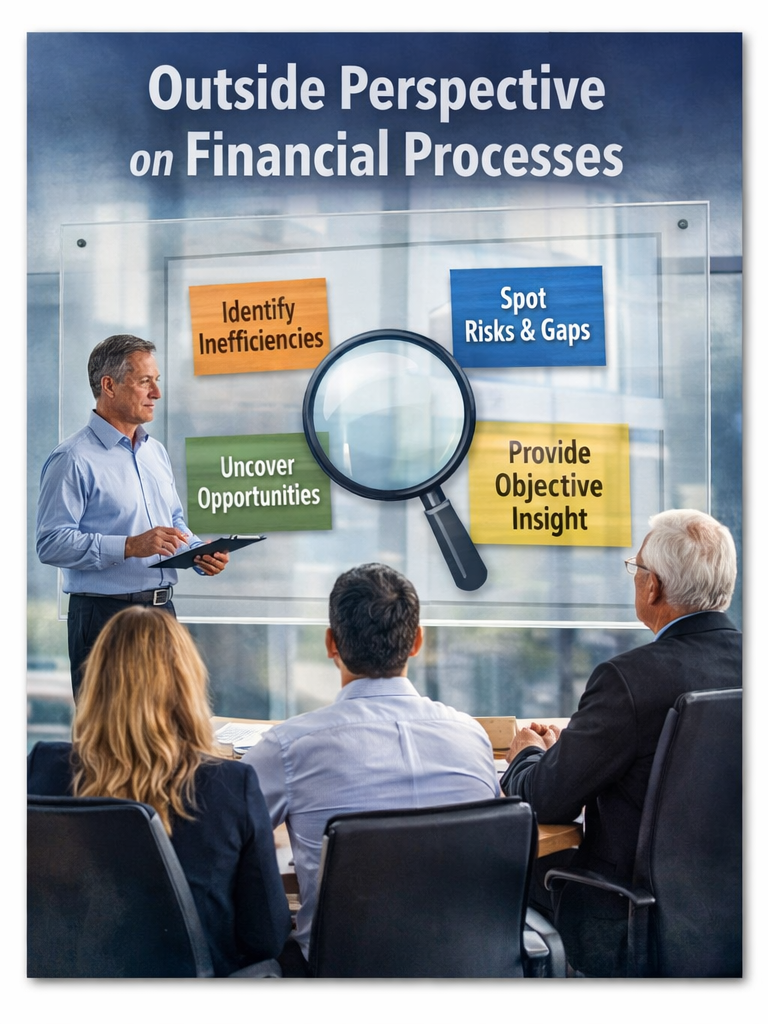

- A fractional CFO brings an objective, experienced perspective that can uncover hidden inefficiencies, risks, and missed opportunities.

- An outside review helps leaders see what they may no longer notice, conduct an honest assessment grounded in facts rather than assumptions, and develop a clear plan for improvement. However, to fully benefit from fractional CFO services, organizations must approach the engagement with a strategic mindset.

- When leadership is open, forward-looking, and committed to long-term value creation, a fractional CFO can transform financial operations into a powerful driver of better decisions, stronger performance, and sustainable growth.

The Power of an Outside Perspective: How Fractional CFO Insight Strengthens Financial Processes for the Long Term

As organizations grow, their financial processes often grow with them — but not always in a structured, intentional way. Systems are added. Reports are layered on top of older reports. Procedures evolve based on urgency rather than design. Over time, what began as practical solutions can quietly become limitations.

From a fractional CFO perspective, one of the most valuable services we provide is not just technical expertise — it’s perspective.

An experienced outsider can see patterns, risks, and opportunities that insiders may overlook simply because they’re too close to the day-to-day work. That outside view can serve as a catalyst for clarity, alignment, and long-term improvement.

But to realize that value, organizations must be willing to take three critical steps:

-

Invite an objective review of financial processes

-

Engage in an honest, unbiased assessment

-

Embrace a strategic mindset focused on long-term outcomes

When these elements come together, fractional CFO services become far more than short-term support — they become a foundation for lasting organizational strength.

1) Why an Outside Review of Financial Processes Matters

Even strong finance teams develop blind spots over time. It’s human nature. When people work within the same systems, reports, and routines for years, inefficiencies can become normalized.

An outsider sees things differently.

A fractional CFO walks into an organization without historical bias, internal politics, or attachment to legacy processes. That independence allows for a fresh, objective evaluation of how financial information is created, used, and communicated.

This outside review often reveals areas such as:

-

Overly manual processes that create risk and slow decision-making

-

Reports that focus on history rather than forward-looking insights

-

Weak alignment between finance, operations, and leadership priorities

-

Gaps in internal controls or documentation

-

Missed opportunities to use financial data strategically

Importantly, the goal isn’t to criticize the existing team. In most cases, finance professionals have done the best they can with the tools, time, and expectations they were given. Instead, the purpose is to identify how the organization can move from “functional” to “strategic.”

An external review also creates a safe environment for improvement. Team members may feel more comfortable acknowledging challenges to someone who isn’t part of internal reporting lines. Leaders gain a neutral voice that can validate concerns or identify issues they sensed but couldn’t clearly define.

In short, an outsider helps answer an essential question:

Are our financial processes helping us move forward — or simply helping us document where we’ve been?

2) Conducting an Honest, Unbiased Initial Assessment

The most impactful fractional CFO engagements begin with a structured, candid assessment. This phase sets the tone for everything that follows.

But the success of that assessment depends on trust and transparency.

An effective initial review typically focuses on several key areas:

Process Evaluation

How does financial information flow through the organization?

-

How long does it take to close the books?

-

How reliable is the data?

-

How much manual effort is required?

Reporting Effectiveness

Are leaders receiving the insights they need?

-

Are reports easy to understand?

-

Do they support decision-making?

-

Are they forward-looking or purely historical?

Strategic Alignment

Is finance connected to operational goals?

-

Do teams understand business priorities?

-

Are financial metrics tied to strategy?

Control Environment

Are risks managed appropriately?

-

Are controls documented and followed?

-

Is accountability clear?

This phase must be honest and objective. That means acknowledging what works well and where improvements are needed. It also means avoiding defensiveness and focusing on progress.

A strong fractional CFO will approach this process with respect and collaboration. The goal is not to “grade” the organization, but to build a shared understanding of reality.

Because clarity creates momentum.

Once leaders and teams agree on the current state, it becomes much easier to design a practical, achievable path forward.

The outcome of a well-executed assessment is not just a list of issues. It’s a roadmap — one that prioritizes improvements based on impact, urgency, and organizational readiness.

This might include:

-

Streamlining reporting structures

-

Strengthening internal controls

-

Enhancing forecasting capabilities

-

Improving communication between finance and operations

-

Developing more strategic performance metrics

With a clear starting point and defined priorities, the organization can begin moving deliberately toward a stronger financial foundation.

3) Why a Strategic Mindset Is Essential to Fully Utilize Fractional CFO Services

Perhaps the most important factor in a successful fractional CFO engagement isn’t technical capability. It’s mindset.

Organizations that see finance as a strategic partner — rather than a back-office function — get the greatest long-term value.

A strategic mindset means leadership is focused on questions like:

-

How can finance help us make better decisions?

-

How can we anticipate risks earlier?

-

How can we use data to shape the future?

-

How do we build systems that support growth?

When leaders approach fractional CFO services with this perspective, the conversation changes.

Instead of asking:

“Can you help us fix this issue?”

They begin asking:

“How can we build something better?”

This shift unlocks the real power of strategic finance.

A fractional CFO can help organizations:

-

Build forward-looking forecasts that support planning

-

Align financial metrics with business priorities

-

Strengthen decision-making through clearer insights

-

Improve communication between departments

-

Create scalable processes that support growth

But these outcomes require commitment.

Leaders must be willing to:

-

Act on recommendations

-

Invest in process improvement

-

Support cultural shifts toward transparency and accountability

-

View finance as a long-term value driver

When that happens, the engagement becomes transformational.

The organization moves from reacting to results…

to shaping them.

From Tactical Support to Long-Term Impact

One of the most common misconceptions about fractional CFO services is that they are primarily for solving short-term problems.

In reality, their greatest value comes from building long-term capability.

A strong engagement helps an organization:

-

Create clarity in its financial operations

-

Build confidence in its numbers

-

Strengthen alignment between strategy and execution

-

Develop leaders who think more strategically

Over time, these improvements compound.

Better processes lead to better information.

Better information leads to better decisions.

Better decisions lead to stronger performance.

And that is where lasting organizational improvement begins.

Final Thoughts

Inviting an outsider to review your financial processes requires openness. It requires trust. And it requires a willingness to hear both strengths and opportunities for growth.

But the payoff is significant.

An objective perspective can reveal what familiarity has hidden. An honest assessment can create alignment and direction. And a strategic mindset can turn financial operations into a powerful engine for long-term success.

From a fractional CFO perspective, the goal is not just to improve reports, controls, or forecasts.

It’s to help organizations build a stronger financial foundation that supports better decisions, sustained growth, and a clearer path forward.

When leaders embrace that vision, they don’t just fix what’s broken.

They build what’s next.

For more related information, please check out The Finance Leader Podcast.